COLUMBIA SPORTSWEAR (COLM)·Q4 2025 Earnings Summary

Columbia Sportswear Beats on Revenue and EPS as International Growth Offsets U.S. Weakness

February 3, 2026 · by Fintool AI Agent

Columbia Sportswear (NASDAQ: COLM) delivered a strong Q4 2025 earnings beat, with revenue of $1.07B topping consensus by 3.7% and EPS of $1.73 crushing estimates by 45%. The outdoor apparel maker absorbed $20M in tariff costs while expanding gross margins and capitalizing on international growth. Shares rose 5.0% to $57.40 following the release.

Did Columbia Sportswear Beat Earnings?

Yes — and it wasn't close on EPS.

*Values retrieved from S&P Global

The revenue upside was driven by better-than-expected conversion of Fall '25 U.S. wholesale orders, partially offset by earlier shipment timing. Despite net sales declining 2% year-over-year, the company delivered meaningfully above Street expectations.

The EPS outperformance reflected gross margin expansion from healthier inventory composition, resulting in less clearance and promotional activity, plus lower inventory loss provisions.

How Did the Stock React?

COLM shares rose +5.0% on February 3, 2026, closing at $57.40. The stock had been trading near 52-week lows heading into the print, with shares down from a 52-week high of $92.88.

The positive reaction reflects:

- Revenue beat despite challenging U.S. environment

- EPS significantly above expectations with tariff headwinds absorbed

- Healthy inventory position — flat in dollars, down 11% in units

- Strong balance sheet — $790.8M cash, no debt

What Changed From Last Quarter?

Momentum shifting to international markets. U.S. sales declined 8% (constant currency), but international regions delivered:

Key regional dynamics:

- China: Up low-double-digits, outdoor category trends remain solid despite dampened winter demand

- Japan: Up mid-to-high single digits, led by wholesale reflecting later shipment of increased Fall '25 orders

- Europe-direct: Up slightly on strong DTC outlet performance, partially offset by lower wholesale

SG&A expense increased 3% YoY ($441.5M vs $430.6M) despite cost savings:

- Increases: Higher DTC expenses including U.S. store impairment charges, non-recurring profit improvement program expenses

- Decreases: Lower enterprise technology and supply chain personnel expenses

Brand performance remained mixed:

- Columbia brand: -1% (largest brand, 88% of Q4 sales)

- SOREL: -18% (earlier Fall '25 wholesale shipments, less clearance activity; full price demand healthy with demand exceeding supply on key styles)

- prAna: +6% (strong momentum from updated product offering, expanding to lifestyle fitness accounts)

- Mountain Hardwear: -5% (healthy underlying trends, strength in outerwear and Summit Grid fleece)

For 2026, management expects all four brands to grow, with emerging brands outpacing Columbia brand growth and prAna leading.

What Did Management Guide?

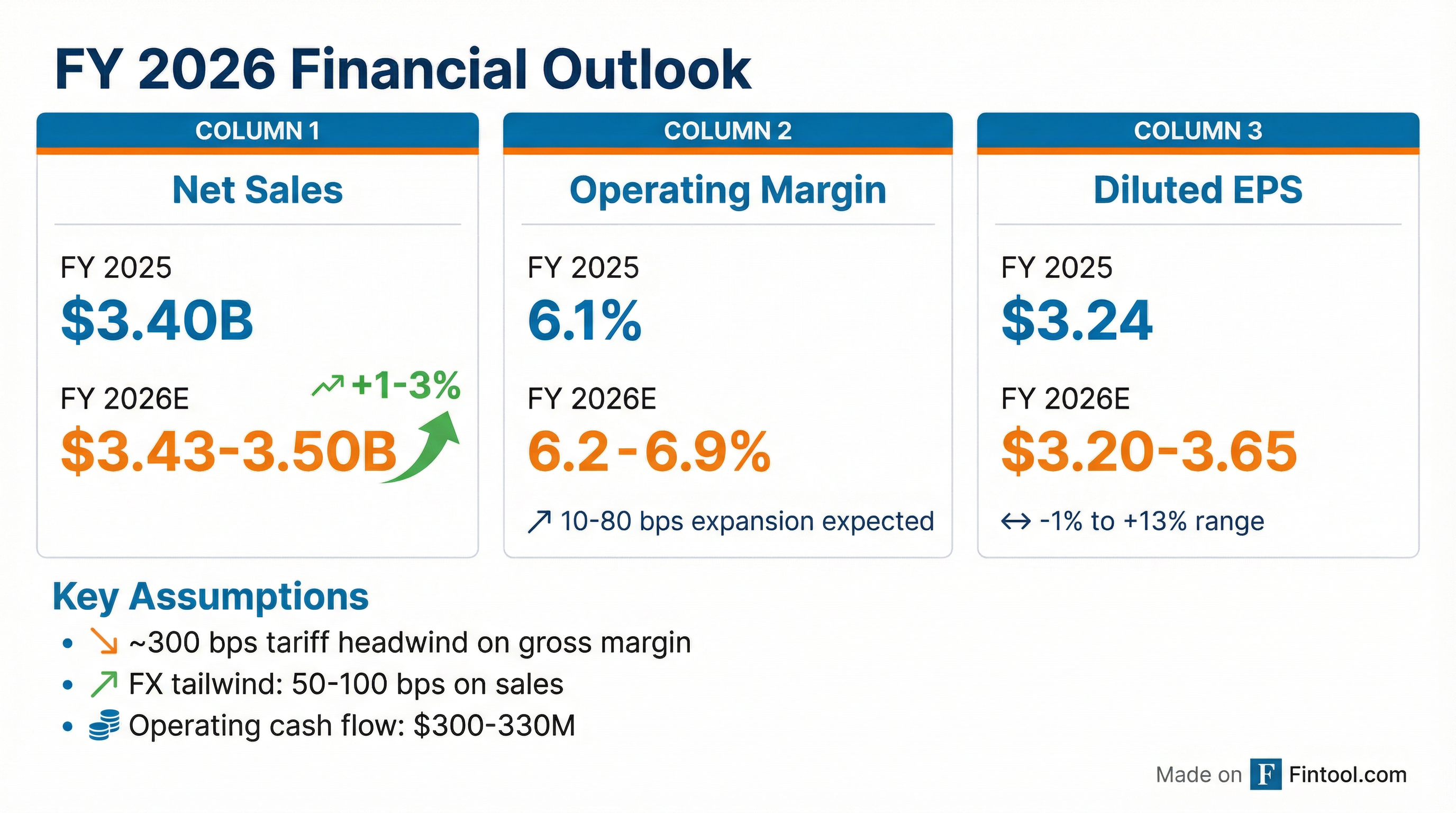

Columbia provided FY 2026 guidance that reflects modest improvement despite significant tariff headwinds:

Full Year 2026 Outlook

Q1 2026 Outlook (Weak Start Expected)

The weak Q1 guidance reflects:

- Decline in U.S. wholesale from lower Spring '26 orders

- U.S. DTC impact from temporary clearance store closures and inventory shortages from cancelled Fall '25 buys (tariff response)

- Unmitigated incremental tariff impact on gross margin

How Is Columbia Handling Tariffs?

Tariffs are the elephant in the room. Here's the breakdown:

2025 Impact:

- Q4 2025: $20M incremental tariff expense absorbed in gross margin

- Full Year 2025: $31M total tariff impact prior to mitigation

2026 Mitigation Strategy:

- ~300 bps gross margin headwind from incremental tariffs expected

- Price increases for Spring '26 and Fall '26 products

- Cost sharing with factory partners

- Channel/regional mix shift toward higher-margin channels

- FX tailwind of 50-100 bps expected to help net sales

CFO Jim Swanson noted the company's 2026 outlook reflects U.S. tariff rates in place as of February 3, 2026.

What Did Management Say?

CEO Tim Boyle on Q4 performance:

"We're pleased to have delivered net sales and profitability exceeding our guidance for the fourth quarter driven by better-than-expected demand in the U.S. While our U.S. business remains challenged, I'm encouraged with continued growth internationally combined with early signs of momentum indicating that the Columbia ACCELERATE Growth Strategy is resonating with consumers."

On brand momentum:

"Over the past few months, we've witnessed brand momentum as consumers embraced our new product collections, with even more exciting launches on the horizon. 'Engineered for Whatever' has not only re-energized our unique brand voice but has provided powerful differentiation in a competitive marketplace."

What Is the ACCELERATE Strategy?

ACCELERATE is Columbia's multi-year consumer-centric growth strategy to elevate the brand and attract younger, more active consumers.

2025 Milestones:

- Launched "Engineered for Whatever" brand platform globally

- Released new products designed for younger, active consumers

- Re-launched U.S. Columbia.com website with enhanced features

Key Pillars:

- Product: Fewer, more powerful collections emphasizing innovation and style

- Brand: Refreshed creative strategy bringing Columbia's personality to life

- Marketing: Higher, more efficient demand creation spending (~6.4% of net sales in 2026)

- Marketplace: Elevated omni-channel brand experiences

Product Success Stories:

- Amaze Puff Collection: Standout success for Fall 2025 — many purchasers were new, first-time brand buyers

- Rock Pant/Rock Light Series: Spring 2026 launch includes differentiated stretch waistband

- OutDry Extreme: Patented waterproof technology using recycled textiles for post-PFAS compliance

Marketing Activations:

- Expedition Impossible: December campaign challenging flat Earthers to find Earth's edge, kicked off with an open letter in The New York Times

- Nature Calls: Super Bowl-adjacent campaign featuring beer brewed with bear scat, with tailgate activation in Santa Clara

- USA Curling: Official uniform sponsor for the 2026 Winter Olympics

Management noted early indicators show differentiated marketing and enhanced products are resonating with consumers, with measurable increases in unaided brand awareness and branded search.

Capital Allocation and Balance Sheet

Columbia maintains a fortress balance sheet with disciplined capital allocation:

The company targets returning at least 40% of free cash flow to shareholders through dividends and share repurchases.

Profit Improvement Plan Progress

Columbia's profit improvement program has delivered substantial cost savings, enabling continued investment in the ACCELERATE strategy:

Savings categories:

- Operational: Normalizing inventories, supply chain transformation, enterprise technology optimization

- Organization: Reduction-in-force primarily impacting U.S. corporate personnel

- Indirect: Strategic sourcing and vendor rationalization

- DTC Store Rationalization: Underperforming store closures

Management noted these savings have helped slow SG&A growth while investing in Columbia's ACCELERATE strategy. Going forward, the company remains committed to driving SG&A expense efficiency and achieving operating margin leverage.

Key Risks and Concerns

- U.S. market weakness persists — Sales down 8% in Q4, expected to decline further in Q1 2026

- Tariff uncertainty — Mitigation strategies only partially offset ~300 bps gross margin headwind

- SOREL brand struggles — Down 18% in Q4, down 7% for full year

- prAna and Mountain Hardwear impairments — $29M charges in 2025 impacted EPS by $0.45

- Weak Q1 2026 outlook — EPS expected to decline 51-61% YoY to $0.29-0.37

Q&A Highlights

On Fall 2026 order book strength:

"We're very encouraged. The bookings have been strong... The bulk of our fall 2026 order book was taken prior to the great weather that we're seeing right now in much of the United States. So we're confident that we've got a good order book for fall 2026, one that we'll be delivering into empty shelves." — CEO Tim Boyle

On Eddie Bauer's 200 store closures:

Columbia sees potential market share gains from competitor distress. Tim Boyle noted Eddie Bauer "relied heavily on its existing reputation as opposed to building in marketing efforts" and while the brand sits "a notch below" Columbia pricing, the company expects to capture incremental business from outdoor consumers as locations close.

On tariff margin impact cadence:

CFO Jim Swanson explained unmitigated tariff costs from 2025 (~$30M) are "stacking" with 2026's ~300 bps headwind, resulting in approximately 400 bps cumulative impact on a two-year basis. Q1 will see "disproportionate impact" since price increases apply to Spring/Fall 2026 but not remaining Fall/Winter goods being sold.

On units vs. pricing dynamics:

The Fall 2026 U.S. wholesale order book shows units down slightly as prices increased high single-digit %. Tim Boyle: "Retailers that we deal with are still unsure about what the elasticity rate is gonna be on some of these more expensive products."

On marketing efficiency:

Marketing spend increased from 5.9% to 6.5% of net sales in 2025 and will be maintained at ~6.4% in 2026. Tim Boyle: "I think we've found an efficient way to get noticed. We've found a way to break through the clutter and in a way that's incredibly efficient."

On remaining order book opportunity:

Orders are taken through end of March, with footwear orders having later deadlines. CFO Swanson noted there's still opportunity to chase demand and place additional inventory purchases through that period.

On sell-through vs. sell-in:

Despite U.S. wholesale sell-in being down high single-digits in H2 2025, sell-through was "up slightly" in dollar terms — the best performing season in several quarters. This gives management confidence in clean channel inventory heading into 2026.

Forward Catalysts

- Q1 2026 earnings: April 30, 2026 — Will tariff mitigation show early traction?

- Spring '26 product launches: Testing pricing power with tariff-related increases

- ACCELERATE traction: Continued momentum with younger consumers

- International expansion: Can LAAP and EMEA offset U.S. weakness?

- Order book updates: Remaining Fall 2026 orders close by end of March — footwear especially

Summary

Columbia Sportswear delivered a solid Q4 2025 beat driven by better-than-expected U.S. wholesale demand and international growth. The company absorbed $20M in tariff headwinds while expanding gross margins through disciplined inventory management. While U.S. challenges persist and Q1 2026 guidance is weak, management's ACCELERATE strategy appears to be gaining traction, and the balance sheet remains pristine with $791M cash and no debt. The +5% stock reaction reflects relief that tariff impacts were manageable and execution remains on track.

Data as of February 3, 2026. Stock prices and estimates sourced from S&P Global and company filings.